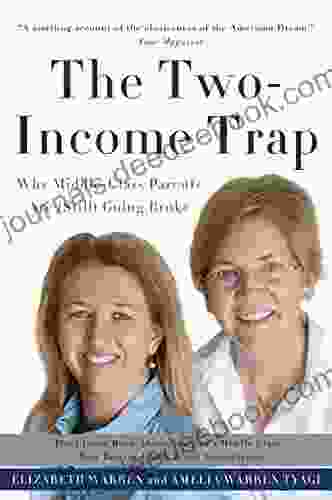

Why Middle Class Parents Are Still Going Broke: An In-Depth Exploration of the Financial Challenges Faced by Median-Income Families in the United States

The middle class, once considered the backbone of the American economy, is facing an unprecedented financial crisis. Despite working hard and earning seemingly respectable incomes, many middle-class families are struggling to make ends meet. This article will investigate the multifaceted reasons why middle-class parents are going broke, shedding light on the systemic issues and personal challenges that contribute to this growing problem.

Rising Costs of Living

One of the most significant factors contributing to the financial woes of middle-class parents is the rising cost of living. In recent years, the cost of essential expenses such as housing, healthcare, and education has skyrocketed, outpacing wage growth.

4.2 out of 5

| Language | : | English |

| File size | : | 4609 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 281 pages |

| X-Ray for textbooks | : | Enabled |

Housing: The median home price in the United States has increased by over 50% since 2012. For many families, this means spending a significant portion of their income on rent or mortgage payments, leaving less for other necessities.

Healthcare: Healthcare costs have been on an upward trajectory for decades. The average annual premium for employer-sponsored health insurance has increased by over 20% since 2010. Additionally, out-of-pocket expenses, such as deductibles and copays, are also on the rise.

Education: The rising cost of education is another major concern for middle-class parents. The average cost of tuition and fees at public four-year colleges has increased by over 150% since 1985. For families with multiple children or those who aspire to send their children to private schools, the financial burden can be overwhelming.

Stagnant Wages and Increased Debt

While the cost of living has been soaring, wages for many middle-class workers have remained stagnant or even declined. The median household income in the United States has barely budged in recent years, despite rising productivity and economic growth.

In order to make ends meet, many families have turned to debt. However, this has led to a cycle of financial distress. Credit card debt, student loans, and other forms of consumer debt have become commonplace for middle-class households, burdening them with high interest rates and monthly payments.

Unexpected Financial Emergencies

Even financially stable middle-class families can be thrown into financial turmoil by unexpected events such as job loss, medical emergencies, or car accidents. These situations can quickly deplete savings and lead to debt or financial ruin.

Job Loss: In today's uncertain job market, job loss can occur at any time. When a breadwinner loses their job, it can have a devastating impact on a family's finances, especially if they are living paycheck to paycheck.

Medical Emergencies: Medical emergencies can result in catastrophic expenses that are not covered by insurance. Even seemingly minor procedures can lead to large medical bills, overwhelming families with debt.

Car Accidents: Car accidents can cause not only physical injuries but also financial setbacks. Uninsured drivers, high deductibles, and extensive repairs can put a significant strain on a family's budget.

Lack of Financial Literacy and Planning

Another contributing factor to the financial struggles of middle-class parents is a lack of financial literacy and planning. Many people do not receive adequate education about personal finance and money management skills.

Financial Literacy: Many adults lack basic financial literacy skills, such as budgeting, saving, and investing. This can lead to poor financial decisions and an inability to manage debt effectively.

Retirement Planning: Retirement planning is often overlooked by middle-class families who are focused on meeting current expenses. However, failing to save adequately for retirement can lead to financial insecurity in later years.

Government Policies and Societal Changes

Government policies and societal changes have also played a role in the financial challenges faced by middle-class parents.

Tax Policies: Tax policies that favor the wealthy and corporations have led to a widening income gap and decreased financial security for the middle class.

Weakened Labor Unions: The decline of labor unions has resulted in reduced bargaining power for workers and stagnant wages.

Increased Childcare Costs: The cost of childcare has risen significantly in recent years, putting a financial burden on working parents, especially single mothers.

Impact on Middle-Class Families

The financial struggles faced by middle-class parents have significant consequences for families and society as a whole.

Financial Stress and Health Problems: Financial stress can lead to mental and physical health problems, such as anxiety, depression, and heart disease.

Reduced Educational Opportunities: When families are struggling to make ends meet, they may have to sacrifice their children's educational opportunities, leading to a decline in social mobility.

Eroded Trust in Institutions: The growing financial insecurity of middle-class families has eroded their trust in institutions such as government and corporations.

Potential Solutions and Policy Recommendations

There are several potential solutions and policy recommendations that could address the financial challenges faced by middle-class parents.

Increase Wages and Promote Job Security: Policies that support wage growth and promote job security, such as raising the minimum wage and implementing universal healthcare, would significantly improve the financial well-being of middle-class families.

Provide Affordable Housing: Government programs and incentives to increase the supply of affordable housing would make it easier for families to afford a decent place to live.

Reform Healthcare: Expanding health insurance coverage and reducing the cost of prescription drugs would alleviate the financial burden of healthcare expenses on middle-class families.

Invest in Education: Making college more affordable and providing access to quality early childhood education would improve the earning potential and financial security of future generations.

Promote Financial Literacy: Implementing financial literacy programs in schools and communities would empower people with the knowledge and skills they need to manage their finances effectively.

The financial struggles faced by middle-class parents are a complex and multifaceted problem. Rising costs of living, stagnant wages, unexpected emergencies, and a lack of financial literacy and planning all contribute to this growing crisis. To address this issue, it is essential to implement policies that support wage growth, provide affordable housing, reform healthcare, invest in education, and promote financial literacy. By taking these steps, we can help ensure the financial security and well-being of middle-class families in the United States.

4.2 out of 5

| Language | : | English |

| File size | : | 4609 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 281 pages |

| X-Ray for textbooks | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Novel

Novel Text

Text Magazine

Magazine Newspaper

Newspaper Bookmark

Bookmark Foreword

Foreword Preface

Preface Annotation

Annotation Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Memoir

Memoir Reference

Reference Dictionary

Dictionary Thesaurus

Thesaurus Character

Character Librarian

Librarian Catalog

Catalog Card Catalog

Card Catalog Stacks

Stacks Archives

Archives Periodicals

Periodicals Research

Research Scholarly

Scholarly Lending

Lending Journals

Journals Rare Books

Rare Books Special Collections

Special Collections Interlibrary

Interlibrary Literacy

Literacy Study Group

Study Group Thesis

Thesis Reading List

Reading List Book Club

Book Club Terry Dobson

Terry Dobson Michelle Knudsen

Michelle Knudsen Leon Russell

Leon Russell Lisa Grace

Lisa Grace Mark Sassano

Mark Sassano Tanya Logan

Tanya Logan Lizzie Page

Lizzie Page Jarvis Cocker

Jarvis Cocker Victoria Pitts Taylor

Victoria Pitts Taylor Dave Rubin

Dave Rubin Izabela Jonek Kowalska

Izabela Jonek Kowalska Daniel D Matthews

Daniel D Matthews Adam C Adler

Adam C Adler K J Maitland

K J Maitland Andy Ziker

Andy Ziker Tony Milne

Tony Milne Jennifer Chiaverini

Jennifer Chiaverini Adam Bradley

Adam Bradley Mateo Blae

Mateo Blae Jordan Elizabeth

Jordan Elizabeth

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Derrick HughesThe Burning and Banning of John Steinbeck's 'The Grapes of Wrath': A Case...

Derrick HughesThe Burning and Banning of John Steinbeck's 'The Grapes of Wrath': A Case...

Jamison CoxEasy Patterns for Wonderfully Whimsical Dolls: Crafting Delightful Characters...

Jamison CoxEasy Patterns for Wonderfully Whimsical Dolls: Crafting Delightful Characters...

David Foster WallaceExploring the Educational Attainments and Criminal Justice Experiences of...

David Foster WallaceExploring the Educational Attainments and Criminal Justice Experiences of... Bradley DixonFollow ·16.1k

Bradley DixonFollow ·16.1k Andy ColeFollow ·18.8k

Andy ColeFollow ·18.8k Corbin PowellFollow ·12.1k

Corbin PowellFollow ·12.1k Jorge AmadoFollow ·18.3k

Jorge AmadoFollow ·18.3k Ethan GrayFollow ·8.7k

Ethan GrayFollow ·8.7k Haruki MurakamiFollow ·4.1k

Haruki MurakamiFollow ·4.1k Allan JamesFollow ·18k

Allan JamesFollow ·18k Andres CarterFollow ·18.1k

Andres CarterFollow ·18.1k

Devon Mitchell

Devon MitchellFiddle Primer for Beginners Deluxe Edition: Your...

Embark on an...

Aldous Huxley

Aldous HuxleyAn Enchanting Journey into the Alluring World of Danielle...

Danielle Steel is an American...

Darren Nelson

Darren NelsonThe Longhaired Boxer: Ed Malave and His Legacy in the...

Ed Malave, known...

Alexandre Dumas

Alexandre DumasThe Tragic True Story Of A Mother Who Lost One Daughter...

No parent should...

Colin Foster

Colin FosterHaunted Places In The American South: An Exploration of...

As the sun dips...

4.2 out of 5

| Language | : | English |

| File size | : | 4609 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 281 pages |

| X-Ray for textbooks | : | Enabled |